Last days for payment of IBIU and VADOS in voluntary period

– June 30 is the deadline for payment in the voluntary period of the Urban Property Tax (IBIU) and the VADOS Tax.

– Once the voluntary payment period has expired, the collection procedure will be carried out with a surcharge of 20%, plus interest for late payment and costs that may be incurred.

– The City Council of Antigua maintains the collection of different fees and taxes in two different periods during the year, to facilitate the payment of the same to the taxpayers.

– The website www.ayto-antigua.es has a separate “PAYMENTS” section that allows online payment of fees and taxes by means of a computer or personal cell phone.

The City Council of Antigua reminds that on June 30, inclusive, ends the voluntary period in the collection this year of the Tax for entry of vehicles through the sidewalks and reserves of the public road for exclusive parking, loading or unloading of goods of any kind or VADOS and the Urban Property Tax, IBIU.

The City Council of Antigua, in order to facilitate tax payments, divides in different periods the different types of fees and taxes, and adds the mayor, Matias Peña Garcia, also reminding that the taxpayer may request the fractionation of their particular payment, if so required.

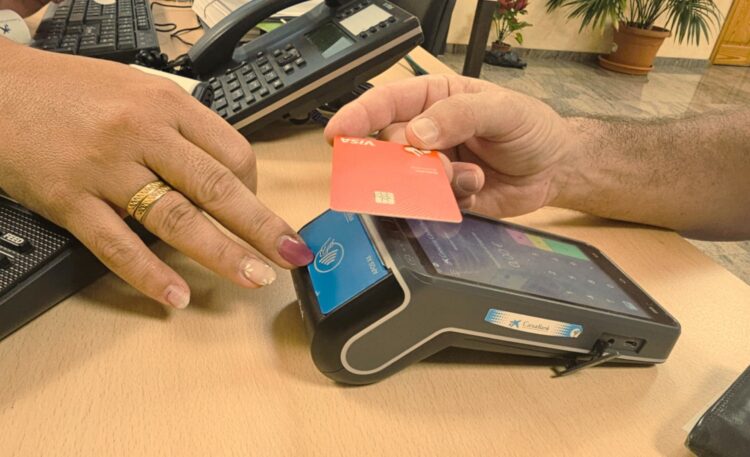

The Municipal Collection Office in the Town Hall of Antigua, will be the place of collection from Monday to Friday from 08:00 to 13:30 hours, by credit or debit card, as well as in the collaborating entities: CaixaBank, Banco Santander and through the web www.ayto-antigua.es in the section differentiated as PAYMENTS. The Town Hall of Antigua reminds taxpayers that the payment of taxes by direct debit will be discounted with 4%.

Once the voluntary payment period has expired, the enforcement procedure will proceed with a surcharge of 20%, plus any late payment interest and costs that may be incurred. This surcharge will be 5% when the unpaid tax debt is paid before notification of the enforcement order to the debtor, and 10% when the unpaid debt is paid within the periods established in the regulations once the enforcement order has been notified. In the latter two cases no late payment interest will be charged.

![Fuerteventura participa en el proyecto ‘Museos [y red] en movimiento’ para impulsar el intercambio patrimonial y profesional en Canarias](https://informacionlocal.es/wp-content/uploads/2025/11/lucerna-romana-1-120x86.jpg)